Pumped storage is by far the most common large-scale grid energy storage available, and the United States Department of Energy Global Energy Storage Database estimates that, as of 2020, PSH accounts for approximately 95 percent of all active recorded storage installations worldwide, with a total deployed capacity of more than 181 GW.

PSH’s round-trip energy efficiency ranges from 70% to 80%, with some sources reporting up to 87 percent. The primary drawback of PSH is the specific design of the appropriate location, which requires both geographical height and water supply.

As the transition to renewables accelerates so will the development of new pumped hydro. So the question on the minds of many must be: How does pumped hydro with a cyclic process and negative net energy production make a profit?

Power Market Revolution

The entire world’s power markets are under a phase of transformation towards sustainable power generation. The aspiration is to reduce carbon dioxide emissions while maintaining a stable supply as generation shifts to Intermittent Renewable Energy Sources (IRES).

Even though renewable energy facilitates a more sustainable and eco-friendly energy generation system, the nature of variability in energy production is innate in such IRES power stations.

Power consumption and power production of a grid system must always be equivalent. In any other situation, there would either be an overload of energy in the grid or a shortage of consumption in the system.

For this reason, it is hard for renewable energy-based stations to be the primary energy generation source of a power grid. An operating power system requires a real-time balance between supply and demand.

Pumped storage hydropower being the prime technology to bridge this demand and supply gap has witnessed the second construction boom of its 100-year history (the first boom being in the 1970s).

PSH can quite easily be called the most viable option for commercialized large-scale energy storage options in the market right now, due to its maturity in design as well as its economical aspects.

Profitability Evaluation

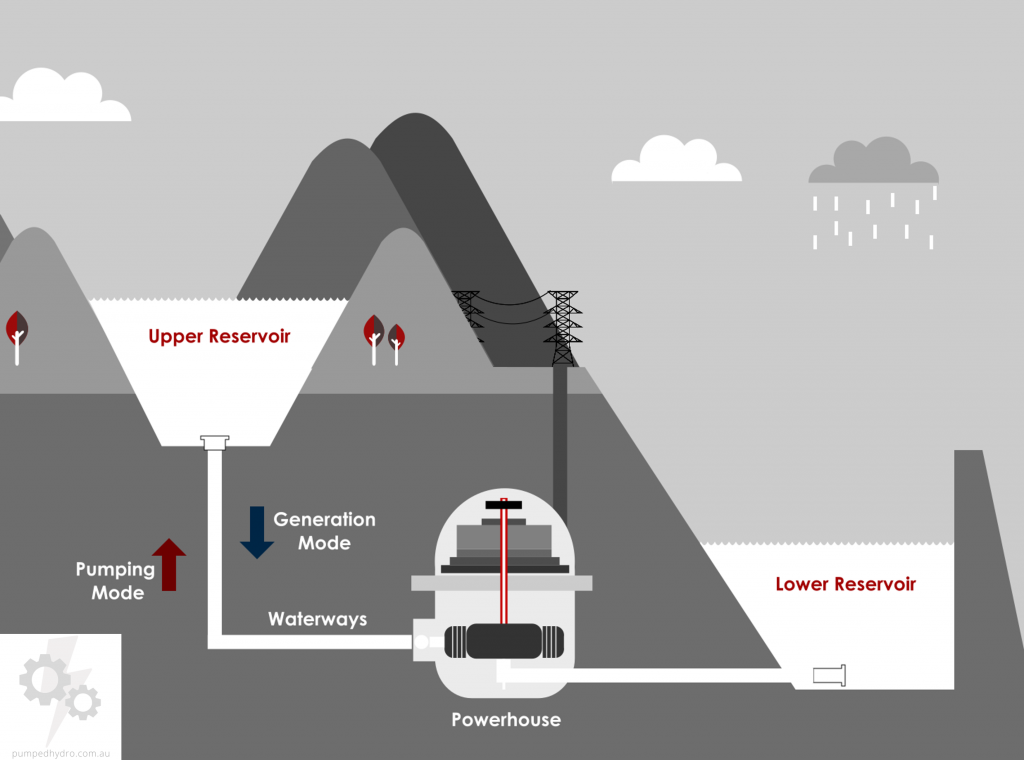

The functioning parameters of pumped storage are roughly the same as conventional hydropower plants. The energy generation is subject to the potential energy in the water, due to the difference in elevation, that is falling on the turbine. The dissimilarity here is the second reservoir.

PSH plants also have a lower reservoir along with the usual reservoir above the power station, connected by a penstock. The water that is used to generate energy is collected in that reservoir below the power station. That water is then pumped up to the upper reservoir.

In essence, this allows for a storage facility that can accumulate and exploit potential energy; during hours of high demand, energy can be generated in the plant and water can be pumped back up to the upper reservoir during hours of low demand, using cheaper electricity.

Costs and Potential Revenues

The cost or expenditure of power plants is broadly divided into two categories. Capital expenditure and operational expenditure.

The money spent on land acquirement and construction, as well as refurbishing, infrastructure development, engineering, and machinery, all are classified as the capital costs of a power plant.

Operational costs, in contrast, include consumables, labour costs, overhaul and outages, cost of spare parts, grid fees plus insurance, and taxes.

Pumped storage hydropower plants are often distinguished by long lead times and high capital expenditure, even though they typically have a long asset life and low operational costs. The capital costs of a PSH project, on the other hand, are heavily dependent on the geological and infrastructure conditions of the site and therefore can differ significantly between projects.

Following IRES integration in the markets, a technical necessity of energy storage and ancillary facilities is expected. However, and regardless of these considerations, in the energy market, the investment decision is essentially made based on the revenue that pumped storage can generate in the available markets.

It is necessary to calculate what is expected from a market in terms of price fluctuations to make a pumped-storage hydropower plant investment viable by estimating market value (possible annual sales on a market) by historical price data and connecting it to the annuity of costs of pumped storages.

Consequently, the outcomes will be rigid and applicable to evolving future demand forecasts.

Pumped storages generate revenue from two sources: spot market price arbitrage and control power. However, the operating concept of a PSH is independent of the market chosen; the aim is always to purchase and sell electricity with the greatest possible price difference – regardless of whether this occurs on the control power market or the spot market.

Below we have discussed the spot price arbitrage ideology in detail.

Spot Price Arbitrage

Arbitrage, by definition, means taking advantage of price differences in/between markets.

How this applies in the electricity market is straightforward. The demand for energy usage is not constant at all times of the day, whether it be in residential or commercial consumption.

Generally, the high and low consumption hours are rather predictable. Hence, generation, as well as price per unit, is adjusted to meet the demand of the consumers.

Using thermal power plants, fluctuating energy production was not that big of a deal. But in IRES power plants, storage (pumped hydro storage) is needed to provide that production smoothening with their excess stored energy. Hence, an optimal pumped storage hydropower plant operating schedule must be established in line with this recurring cyclic peak pattern of energy demand and the per-unit price of electricity.

The potential revenue from price arbitrage could be calculated from the mean price comparison between the pumping and generating hours.

A general price per unit electricity graph of a regular residential community is shown below. The electricity prices are in correspondence with traditional consumption patterns. Prices have peaked during the morning and evening with relatively lower prices occurring during weekday nights.

However, the assessment should also consider the uncertainty that a PSHP operator faces; without sufficient foresight, optimum activity judgments are impossible to make.

Limitations and Uncertainties

As mentioned previously, the feasibility assessment of pumped storage investment and revenue is bound by uncertainties.

Even though annual costs can be formulated as ranges of potential outcomes to account for project variation, the modelled price arbitrage effects are also dependent on design variables, mostly pump and turbine power, but also the relationship between the two, as well as storage space.

Following an initial estimation, these parameters must be adjusted to meet the anticipated market conditions. For example, in markets with non-curtailment IRES policies, a larger pump rather than a generator might be recommended to consume energy efficiently during periods of oversupply.

However, since this optimization is subject to market conditions, all these variables are largely dependent on their specific projects.

Technological Progress and Innovative design Prospects

Traditional PSH facilities were typically designed with enough storage to provide 6 or 8 hours of maximum discharge at peak hours.

This storage capacity was adequate for the continuous operation of less flexible (usually thermal) generation. Since peak hours, during the day, were much less than off-peak hours, during the night and on weekends, most projects focused on making larger generation capacity than pumping capacity.

However, the introduction of IRES into the power system necessitates a different form of flexibility, to which PSH architecture must adjust.

Fluctuations in demand and price would be less stable than in a day/night service, necessitating a greater reliance on price forecasts. Furthermore, the optimum PSH configuration would become increasingly dependent on market conditions and local power system characteristics.

The storage space of pumped storage defines the time horizons available for service. With a greater need for flexibility in time horizons longer than one day, a larger storage capacity would be needed.

Although, such altercations in a mature technology sound impractical to a great degree. Hence, innovations will be required to overcome such obstacles in the growth of renewable energy-reliant power grids.